Nearly 17 years back, when web dating was mainstream yet at the same time sort of humiliating to discuss, I met a creator who was especially bullish on the training. A huge number of individuals, he stated, have discovered satisfying connections on the web. Were it not for the web, they would presumably never have met.

A ton of years have gone from that point forward. However on account of Joe Schwartz, a writer of a 20-year-old dating counsel book, "satisfying relationship" is as yet the term that sticks in my mind while examining the ultimate objective of web dating apparatuses.

Satisfying is an ambiguous term, yet likewise particularly precise. It includes everything from the eternity love of a perfect partner to the transitory fix of a one-night stand. Sentimental people can discuss intimate romance. However with regards to the calculation and-swipe-driven universe of web based dating, it's about satisfaction.

It is in view of this, incidental with the entry of Valentine's Day, that Crunchbase News is investigating the condition of that most cumbersome of pairings: new businesses and the quest for finding a mate.

Blending cash

Before we go further, be cautioned: This article will do nothing to enable you to explore the highlights of new dating stages, tweak your profile or discover your perfect partner. It is composed by somebody whose center aptitude is gazing at startup financing information and thinking of patterns.

Along these lines, in case you're OK with that, we should continue. We'll begin with the underlying perception that while web based dating is a huge and frequently entirely beneficial industry, is anything but a tremendous magnet for endeavor subsidizing.

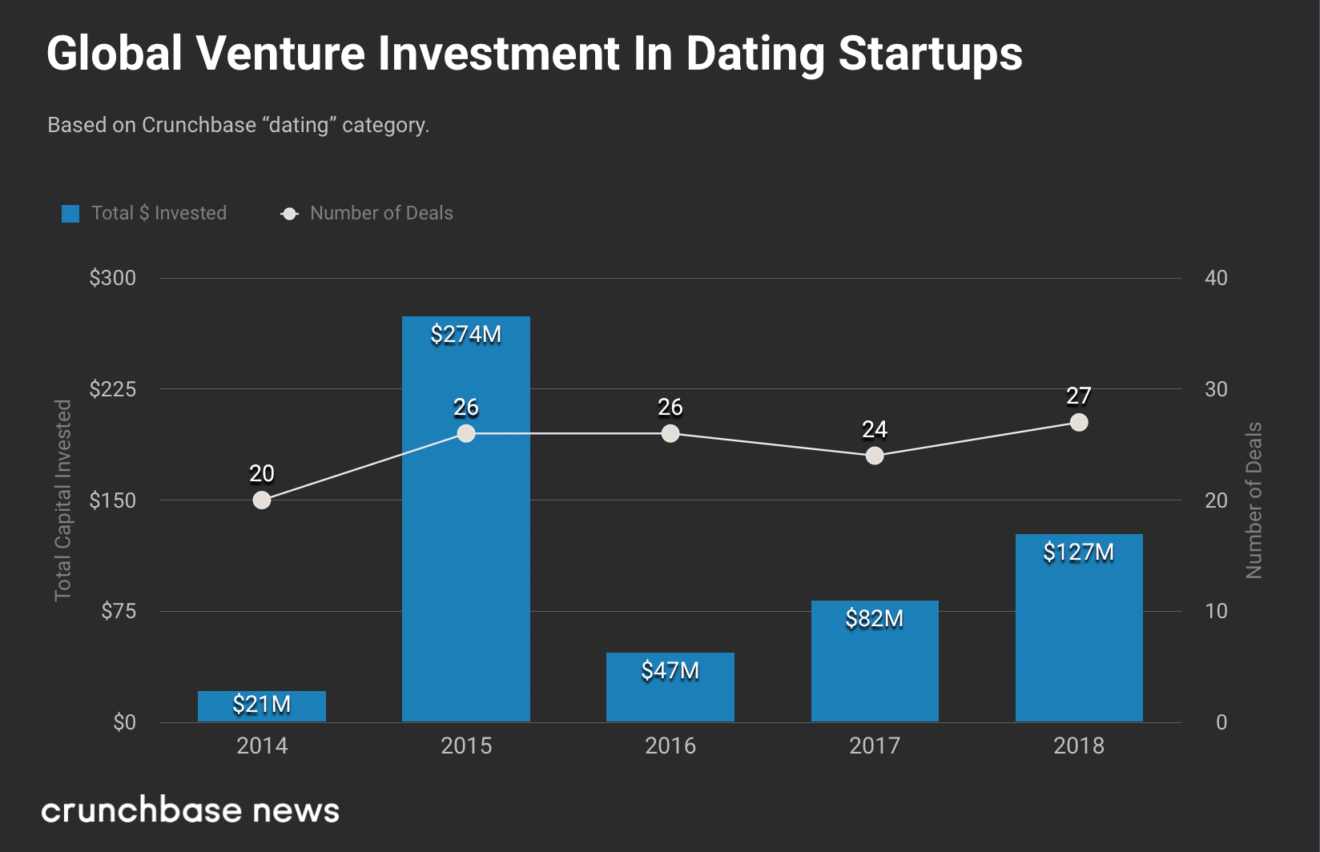

In 2018, for example, adventure financial specialists put $127 million universally into 27 new businesses classified by Crunchbase as dating-centered. While that is not sucker change, it's absolutely small contrasted with the more than $300 billion in worldwide endeavor venture over all segments a year ago.

In the graph underneath, we take a gander at worldwide endeavor interest in dating-centered new companies in the course of recent years. The general finding is that round tallies vary modestly year-to-year, while venture aggregates change intensely. The last is because of a bunch of goliath financing rounds for China-based new companies.

While the U.S. gets the most responsibilities, China gets the greatest ones

While the U.S. is home to most of financed new businesses in the Crunchbase dating classification, the greater part of speculation has gone to China.

In 2018, for example, almost 80 percent of dating-related speculation went to a solitary organization, China-based Blued, a Grindr-style hookup application for gay men. In 2017, the greater part of capital went to Chinese versatile dating application Tantan, and in 2014, Beijing-based matchmaking site Baihe raised an amazing $250 million.

Then, in the U.S., we are seeing a combination of new businesses raising littler rounds, yet no enormous revealed financings in the previous three years. In the outline underneath, we take a gander at a couple of the biggest financing beneficiaries.

Dating application results

Dating destinations and applications have produced some strong exits in the previous couple of years, just as some less-excellent results.

Versatile centered matchmaking application Zoosk is a standout amongst the most vigorously financed players in the space that presently can't seem to produce an exit. The San Francisco organization raised more than $60 million somewhere in the range of 2008 and 2012, yet needed to pull back an arranged IPO in 2015 because of hailing market premium.

New companies without realized endeavor financing, in the interim, have figured out how to acquire some greater results. One champion in this class is Grindr, the geolocation-fueled dating and hookup application for gay men. China-based tech firm Kunlun Group purchased 60 percent of the West Hollywood-based organization in 2016 for $93 million and allegedly paid around $150 million for the rest of the stake a year back. Another clear example of overcoming adversity is OkCupid, which sold to Match.com in 2011 for $50 million.

Concerning adventure sponsored organizations, one of the prior subsidized new companies in the web based matchmaking space, eHarmony, scored a leave the previous fall with an obtaining by German media organization ProSiebenSat.1 Media SE. In any case, terms weren't revealed, making it hard to check returns.

One startup VCs are definitely upbeat they passed on is Ashley Madison, a site best known for focusing on wedded individuals looking for issues. An endeavor speculator pitched by the organization years prior revealed to me its financials were very amazing, yet its center zone would not pass marshal with firm financial specialists or the VCs' life partners.

The dating site in the long run ended up overwhelmed in embarrassment in 2015 when programmers stole and discharged for all intents and purposes the majority of its client information. Quite, the site is still near, a unit of Canada-based dating system ruby. It has changed its aphorism, be that as it may, from "Life is short. Engage in extramarital relations," to "Discover Your Moment."

A calculation picked match

With the soul of Valentine's Day noticeable all around, it happens that I ought to repeat the self-evident: Startup financing databases don't contain much about sentimental love.

The Crunchbase informational collection delivered no subsidized U.S. new businesses with "sentimental" in their business portrayals. Only five utilized "sentiment" (of which one is a virus blend tea organization).

We get it. Our social originations of sentiment are emphatically low-tech. We consider verse, blossoms, portions of bread and containers of wine. We don't consider calculations and swipe-driven versatile stages.

Dating destinations, as well, appear to lean toward advancing themselves on common sense and adequacy, as opposed to sentiment. Take how Match Group, the biggest traded on an open market player in the dating amusement, depicts its business by means of that most swoon-prompting of epistles, the 10-K report: "Our methodology centers around a brand portfolio approach, through which we endeavor to offer dating items that all things considered intrigue to the broadest range of customers."

That sort of composing may kill sentimental people, however investors adore it. Offers of Match Group, whose portfolio incorporates Tinder, have dramatically multiplied since Valentine's Day 2017. Its present market top is around $16 billion.

A ton of years have gone from that point forward. However on account of Joe Schwartz, a writer of a 20-year-old dating counsel book, "satisfying relationship" is as yet the term that sticks in my mind while examining the ultimate objective of web dating apparatuses.

Satisfying is an ambiguous term, yet likewise particularly precise. It includes everything from the eternity love of a perfect partner to the transitory fix of a one-night stand. Sentimental people can discuss intimate romance. However with regards to the calculation and-swipe-driven universe of web based dating, it's about satisfaction.

It is in view of this, incidental with the entry of Valentine's Day, that Crunchbase News is investigating the condition of that most cumbersome of pairings: new businesses and the quest for finding a mate.

Blending cash

Before we go further, be cautioned: This article will do nothing to enable you to explore the highlights of new dating stages, tweak your profile or discover your perfect partner. It is composed by somebody whose center aptitude is gazing at startup financing information and thinking of patterns.

Along these lines, in case you're OK with that, we should continue. We'll begin with the underlying perception that while web based dating is a huge and frequently entirely beneficial industry, is anything but a tremendous magnet for endeavor subsidizing.

In 2018, for example, adventure financial specialists put $127 million universally into 27 new businesses classified by Crunchbase as dating-centered. While that is not sucker change, it's absolutely small contrasted with the more than $300 billion in worldwide endeavor venture over all segments a year ago.

In the graph underneath, we take a gander at worldwide endeavor interest in dating-centered new companies in the course of recent years. The general finding is that round tallies vary modestly year-to-year, while venture aggregates change intensely. The last is because of a bunch of goliath financing rounds for China-based new companies.

While the U.S. gets the most responsibilities, China gets the greatest ones

While the U.S. is home to most of financed new businesses in the Crunchbase dating classification, the greater part of speculation has gone to China.

In 2018, for example, almost 80 percent of dating-related speculation went to a solitary organization, China-based Blued, a Grindr-style hookup application for gay men. In 2017, the greater part of capital went to Chinese versatile dating application Tantan, and in 2014, Beijing-based matchmaking site Baihe raised an amazing $250 million.

Then, in the U.S., we are seeing a combination of new businesses raising littler rounds, yet no enormous revealed financings in the previous three years. In the outline underneath, we take a gander at a couple of the biggest financing beneficiaries.

Dating application results

Dating destinations and applications have produced some strong exits in the previous couple of years, just as some less-excellent results.

Versatile centered matchmaking application Zoosk is a standout amongst the most vigorously financed players in the space that presently can't seem to produce an exit. The San Francisco organization raised more than $60 million somewhere in the range of 2008 and 2012, yet needed to pull back an arranged IPO in 2015 because of hailing market premium.

New companies without realized endeavor financing, in the interim, have figured out how to acquire some greater results. One champion in this class is Grindr, the geolocation-fueled dating and hookup application for gay men. China-based tech firm Kunlun Group purchased 60 percent of the West Hollywood-based organization in 2016 for $93 million and allegedly paid around $150 million for the rest of the stake a year back. Another clear example of overcoming adversity is OkCupid, which sold to Match.com in 2011 for $50 million.

Concerning adventure sponsored organizations, one of the prior subsidized new companies in the web based matchmaking space, eHarmony, scored a leave the previous fall with an obtaining by German media organization ProSiebenSat.1 Media SE. In any case, terms weren't revealed, making it hard to check returns.

One startup VCs are definitely upbeat they passed on is Ashley Madison, a site best known for focusing on wedded individuals looking for issues. An endeavor speculator pitched by the organization years prior revealed to me its financials were very amazing, yet its center zone would not pass marshal with firm financial specialists or the VCs' life partners.

The dating site in the long run ended up overwhelmed in embarrassment in 2015 when programmers stole and discharged for all intents and purposes the majority of its client information. Quite, the site is still near, a unit of Canada-based dating system ruby. It has changed its aphorism, be that as it may, from "Life is short. Engage in extramarital relations," to "Discover Your Moment."

A calculation picked match

With the soul of Valentine's Day noticeable all around, it happens that I ought to repeat the self-evident: Startup financing databases don't contain much about sentimental love.

The Crunchbase informational collection delivered no subsidized U.S. new businesses with "sentimental" in their business portrayals. Only five utilized "sentiment" (of which one is a virus blend tea organization).

We get it. Our social originations of sentiment are emphatically low-tech. We consider verse, blossoms, portions of bread and containers of wine. We don't consider calculations and swipe-driven versatile stages.

Dating destinations, as well, appear to lean toward advancing themselves on common sense and adequacy, as opposed to sentiment. Take how Match Group, the biggest traded on an open market player in the dating amusement, depicts its business by means of that most swoon-prompting of epistles, the 10-K report: "Our methodology centers around a brand portfolio approach, through which we endeavor to offer dating items that all things considered intrigue to the broadest range of customers."

That sort of composing may kill sentimental people, however investors adore it. Offers of Match Group, whose portfolio incorporates Tinder, have dramatically multiplied since Valentine's Day 2017. Its present market top is around $16 billion.

Comments

Post a Comment